Quantitative Financial Risk Management: awesome OOP tools for measuring, managing and visualizing risk of financial instruments and portfolios.

Project description

Quantitative Financial Risk Management (QFRM) project is a (rapidly growing) set of analytical tools to measure, manage and visualize identified risks of derivatives and portfolios in finance.

Why use Quantitative Financial Risk Management (QFRM) package:

We apply object-oriented programming (OOP) paradigm to abstract the complexities of financial valuation and simplify the use of this package.

Plentiful examples (referencing underlying textbook and real-world) virtually eliminate the learning curve (of package use) and bridge you directly to your analysis in seconds.

QFRM uses numbers and tuples of numbers as inputs/outputs (I/O) for simplicity, consistency and usability.

Most internal computations are done on tuples for fantastic computational performance. Occasionally, we use more complex data (and significantly slower) structures (like DataFrame, nparray, …) to educate the interested on interoperability of objects. FYI: in our tests, tuple outperforms DataFrame by a factor of 300.

We try to sensibly vectorize our functions to help you with application of QFRM functionality.

All programing is done with usability/scalability/extendability/performance in mind.

This project grows rapidly with an effort from a dozen of bright quant finance developers. Check back for updates throughout Fall 2015.

Our Team:

This is a group of ambitious and diligent Rice University science students studying statistics, mathematics, physics, chemistry, computer science, engineering, finance, economics, and other fields. These doctoral, masters and undergraduate students are united in their work to expand and contribute to finance community and QFRM course, led by Oleg Melnikov, a doctoral student and instructor at Stat Dept of Rice U.

Oleg Melnikov (author, creator), Department of Statistics, Rice University, http://Oleg.Rice.edu, <xisreal@gmail.com>

TBA

…

Structure and functionality:

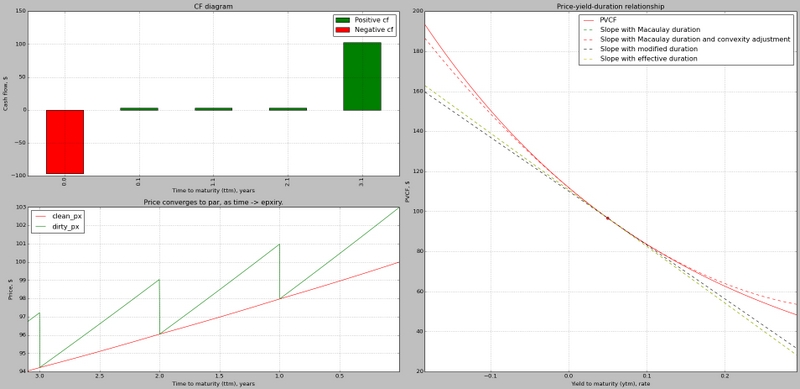

- class PVCF (present value of cash flows) accepts time-indexed cash flows and a yield curve to compute:

net present value (NPV), internal rate or return (IRR), time value of money (TVM)

Linearly interpolated yield curve with time-to-maturities (TTM) matching those of cash flows (CF)

Visualization: CF diagram

- class Bond (inherits PVCF) accepts coupon/frequency/TTM specification along with optional yield curve (with optional TTM) to compute:

- Valuation and performance analytics: clean/dirty price, yield to maturity (ytm), par and current yield

interest rates (IR) are assumed to be continuously compounded (CC), but user has a method to convert from/to any frequency.

Risk analytics: Macaulay/Modified/Effective durations, convexity

Visualization: CF diagram, dirty/clean price convergence, price sensitivity curves and slopes with and without convexity adjustment.

class Util provides some helpful functionality for verifying/standardizing in I/O of other class’ methods.

Planned implementation:

Fixed income portfolio analytics, exotic option pricing (via lattice, Black-Scholes model (BSM), Monte Carlo simulations, and Finite Differencing Methods (FDM)), and further visualization of concepts in finance.

Genesis:

This project started as a QFRM R package in Spring 2015 QFRM course (STAT 449 and STAT 649) at Rice University.

The course is part of computational finance and economic systems (CoFES) program, led by Dr. Katherine Ensor.

Underlying textbook (source of financial calculations and algorithms)

Options, Futures and other Derivatives by John C. Hull, 9ed, 2014, ISBN 0133456315

It is a well established textbook (the so called “bible of derivatives”) in finance and risk management. Most major certification exams in finance list this text among the core material.

Install:

Directly from PyPI with pip command in a terminal (or windows command, cmd.exe) prompt, assuming pip is in your PATH:

$ pip install qfrmTypical usage:

3% annually-paying bond with 3.1 TTM (in years), evaluated at 5% continuously compounded (CC) yield-to-maturity (YTM), i.e. flat yield curve (YC)

>>> Bond(3,1,3.1, pyz=.05).analytics()

------------------ Bond analytics: ------------------------

* Annual coupon, $: 3

* Coupon frequency, p.a.: 1

Time to maturity (ttm), yrs: 3.1

* Cash flows, $ p.a.: (3.0, 3.0, 3.0, 103.0)

Time to cash flows (ttcf), yrs: (0.10000000000000009, 1.1, 2.1, 3.1)

Dirty price (PVCF), $: 96.73623

* Clean price (PVCF - AI), $: 94.03623

YTM, CC rate: 0.05

YTM, rate at coupon frequency: 0.05127

Current yield, rate at coupon frequency: 0.0319

* Par yield, rate at coupon frequency: 0.03883

Yield curve, CC rate: (0.05, 0.05, 0.05, 0.05)

Macaulay duration, yrs: 2.9208

Modified duration, yrs: 2.77835

Effective duration, yrs: 2.92126

* Convexity, yrs^2: 8.92202

Desc: {}

------------------------------------------------------------------------------

Median run time (microsec) for 1 iteration(s): 11604.918843659107

Textbook example (default) of 6% SA bond with 2 years/time to maturity (TTM), see p.83 in Hull’s OFOD/9ed

>>> Bond().analytics()4% semi-annual (SA) bond with 4.25 ttm (4 years and 3 mo), evaluated at $97.5 PVCF (which computes to 4.86% ytm or flat YC)

>>> b = Bond(4,2,4.25, pyz=97.5)

>>> b.ytm() # compute yield from supplied (PVCF) price ($97.5 assumed)

0.048615328294339864

>>> b.ytm(px_target=(97.5, 98, 99, 100, 101)) # vectorized computation of yield-to-maturity

(0.048615328294339864, 0.047305618596811434, 0.04470725938701976, 0.04213648737177501, 0.039592727021145635)

>>> b.analytics() # prints full report and visualizationThe same 4% SA bond evaluated with a specific YC. Zero rates are assumed to have TTM matching those of cash flows (CF), left to right. Insufficient rates are extrapolated with a constant.

>>> b.set_pyz(pyz=(.05,.06,.07,.08)).analytics()The same 4% SA bond evaluated with a specific YC. User provides zero rates with corresponding TTM. TTM required to evaluate CF are extra/interpolated from existing curve with constant rates on each side.

>>> b.set_pyz(pyz=(.05,.06,.04,.03), ttz=(.5,1,2,6)).analytics()This project uses industry-accepted acronyms:

AI: accrued interest

APT: arbitrage pricing theorem

ASP: active server pages (i.e. HTML scripting on server side) by Microsoft

b/w: between

bip: basis points

BM: Brownian motion (aka Wiener Process)

Bmk: benchmark

BOPM: binomial option pricing model

bp: basis points

BSM: Black-Scholes model or Black-Scholes-Merton model

BT: binomial tree

c.c.: continuous compounding

CC: continuous compounding

CCP: central counterparty

CCRR: continuously compounded rate of return

CDS: credit default swap

CDO: credit default obligation

CF: cash flows

Cmdt: commodity

Corp: corporate (finance or sector)

CP: counterparty (in finance)

CUSIP: Committee on Uniform Security Identification Procedures, North-American financial security identifier (like ISIN)

ESO: employee stock option

ETD: exchange-traded derivative

FE: financial engineering

FDM: Finite differencing method

FRA: forward rate agreement

FRN: floating rate notes

Fwd: forward

FX: foreign currency or foreign currency exchange

FV: future value

GBM: geometric Brownian motion

Gvt: government

Hld: holding

Idx: index

IM: initial margin

IR: interest rate

IRD: interest rate derivatives

IRTS: interest rate term structure

ISIN: International Securities Identification Number

LIBID: London Interbank bid rate

LIBOR: London Interbank Offered Rate

LT: lattice tree (i.e binomial, trinomial, …)

MA: margin account; moving average

MC: margin call

MC: Monte Carlo simulation

Mgt: management

Mkt: market

MM: maintenance margin

MP: Markov process

MTM: marking to market

Mtge: mortgage

MV: multivariate

OFOD: Options, Futures, and Other Derivatives

OFOD9e: Options, Futures, and Other Derivatives, 9th edition

OIS: overnight index SWAP rate

OOP: object oriented programming

p.a.: per annum

PD: probability of default

PDE: partial differential equation

PM: portfolio manager

PORTIA: portfolio accounting system by Thomson Financial

Pts: points

PV: present value

PVCF: present value of cash flows

QFRM: quantitative financial risk management

REPO: Repurchase agreement rate

RFR: risk free rate

RN: risk-neutral

RNW: risk-neutral world

RoI: return on investment

RoR: rate of return

r.v.: random variable

s.a.: semi-annual

SA: semi-annual

SAC: semi-annual compounding

SP: stochastic process

SQL: sequel query language

SQP: standard Wiener process

SURF: step up recovery floaters (floating rate notes)

TBA: to be announced

TBD: To be determined

TOMS: Trade Order Management Solution (or System)

Trx: transaction

TS: time series

TSA: time series analysis

TTCF: time to cash flows

TTM: time to maturity

TVM: time value of money

UDF: user defined function

URL: universe resource locator

VaR: value at risk

Var: variance

VB: Visual Basic (by Microsoft)

VBA: Visual Basic for Applications

Vol: volatility

WAC: weighted-average coupon

WAM: weighted-average maturity

WP: Wiener process (aka Brownian motion)

YC: yield curve

Yld: yield

ZCB: zero coupon bond

Project details

Release history Release notifications | RSS feed

Download files

Download the file for your platform. If you're not sure which to choose, learn more about installing packages.